A Win-Win for Donors and Community

The Community Investment Tax Credit provides an opportunity for individuals and businesses to reduce their Maryland tax liability while making a

targeted impact on their community. The program is intended to foster private sector and nonprofit partnerships by providing incentives to businesses and individuals to support community projects they care about.

The Kent Center is focused on helping adults with disabilities have a safe and comfortable place to call home. Through the growth and investment of our Community Living program, more persons served will experience the personal fulfillment of living independently of their families. Kent Center has $20,000 in available tax credits that can be awarded to qualifying gifts. Donations toward this program assist Kent Center in upgrading handicap access points to homes, replacing appliances and electrical systems, and completing necessary renovation projects.

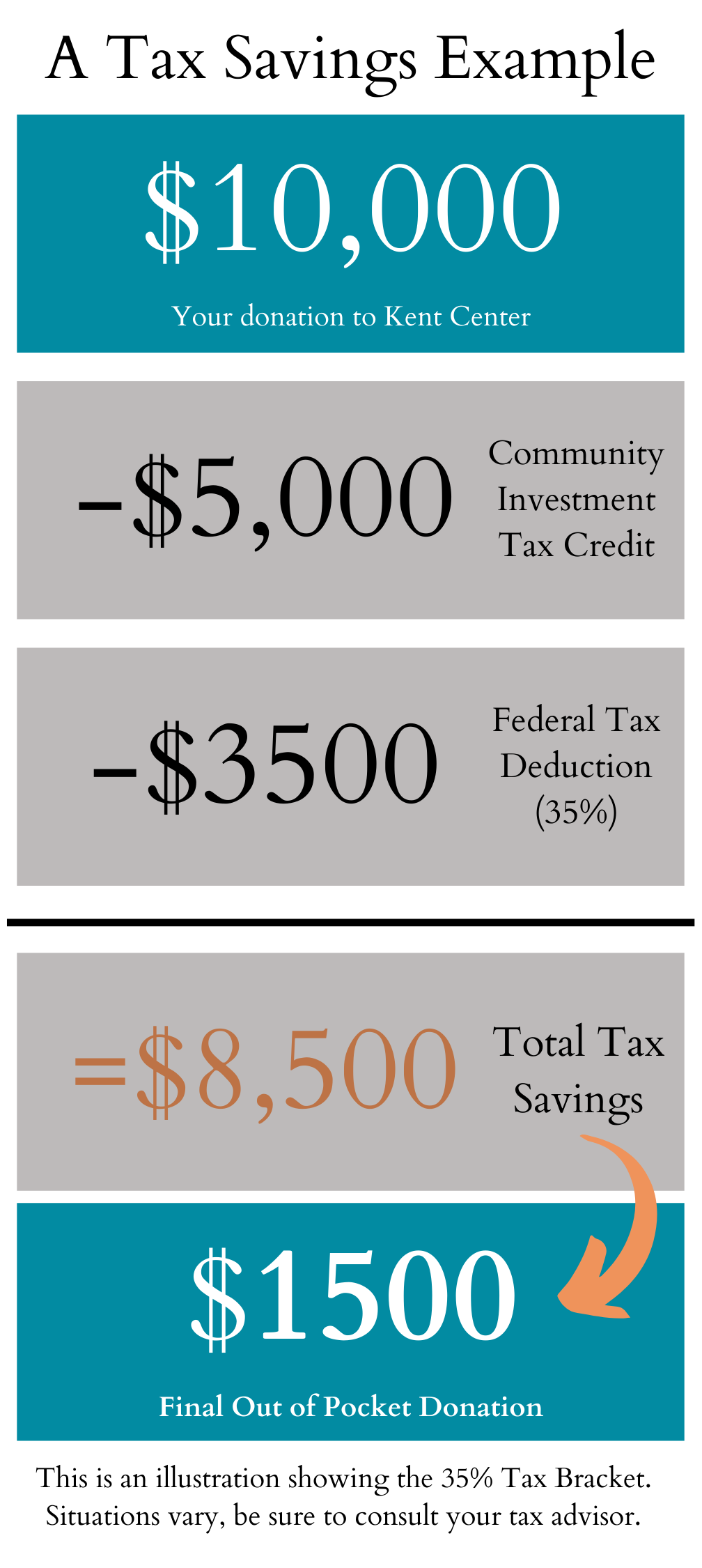

Individuals and businesses that donate to an organization’s approved projects earn Maryland tax credits equal to 50% of the value of their qualifying contribution. These credits are in addition to the deductions on both Federal and State taxes for the charitable contribution. Individuals and businesses must use the tax credits against Maryland taxes owed for the year in which the contribution is made. Anyone contemplating a donation is encouraged to consult with their tax professional for information about their specific tax benefits, based on their situation.

The minimum contribution to qualify for a tax credit allocation is $500 and must be received by December 31, 2021. The paperwork is minimal and we help you complete it! Businesses and individuals may donate up to $250,000 in one year, utilizing many Maryland non-profit’s tax credits. Tax credits may be rolled over 3 years to cover a business or individual’s Maryland tax obligation.

Contributions of $500 or more may be made by check payable to Kent Center, Inc. and mailed to or dropped off to 215 Scheeler Road, Chestertown MD. This program requires a signed form authorizing the Department of Housing and Community Development to process the tax credits within the Community Investment Tax Credit program. This form must be signed and dated prior to the date of the contribution. Within thirty days of receipt, donors should expect our letter evidencing receipt of the contribution from Kent Center. The tax credit certificate will be delivered via email with three months with instructions on how to claim the credit. Donors are encouraged to make their donation early in the fall to avoid delays in receiving their certification letters for the tax filing year.

For more information, contact Courtney Williams at 410-778-7303, ext. 37 – or the State of MD, CITC Program at 410-514 -7280.